Talent Acquisition

BlackmoreConnects Talent approach sets us apart from typical recruiting services. Rather than merely facilitating job placements, we are fully immersed in the dynamic and ever-evolving world of investors. We don’t just match candidates with opportunities; we live and breathe the intricacies of the investment landscape. Since 2005, our extensive LinkedIn network of experience with PE executives has provided us with unparalleled insights and access to exclusive opportunities. We don’t rely on a one-size-fits-all approach; instead, we tailor our recruitment strategies to meet the specific needs and aspirations of both our clients and candidates.

Our talent team consists of professionals who have spent over 20+ years working and thriving in PE. We have repeatedly achieved success in assembling management teams for our own companies. Our extensive experience equips us with an understanding of the nuances within this highly competitive field. This knowledge allows us to identify not just the right skills and qualifications in candidates, but also the intangible qualities that make someone an ideal fit for the investment world.

PRIVATE EQUITY AND M&A FOCUS

BMC Executives are selected and screened with their industry backgrounds as best fits for Private Equity and M&A businesses. BMC also provides our senior-level professionals with supplementary education in the Private Equity and M&A process to ensure professionalism and a smooth recruitment process.

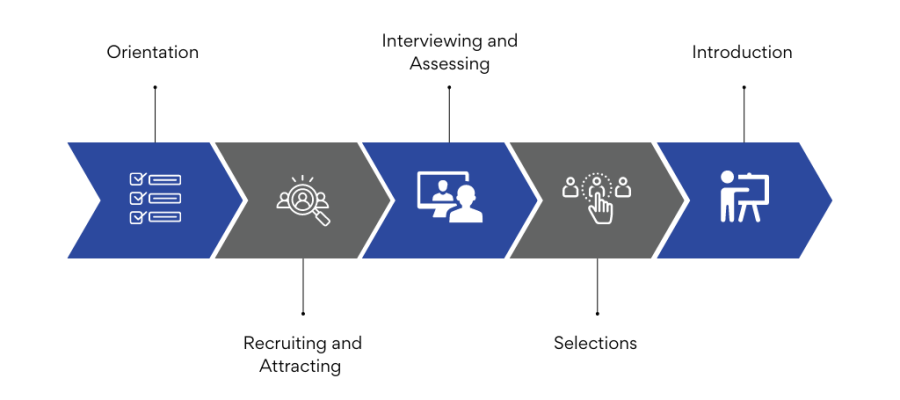

TALENT ACQUISITION PROCESS

Specialized Expertise: Our in-depth knowledge of the investment world means we can offer a level of expertise that general recruiting services simply cannot match. We understand the intricacies of the financial industry, from regulatory changes to market trends, giving our clients and candidates a significant advantage.

Targeted Matches: By living and breathing the investor’s world, we can make highly targeted and precise matches. We don’t just look at resumes; we understand the cultural fit, soft skills, and industry-specific knowledge that are crucial for success in the financial sector.

Strategic Approach: We take a strategic approach to recruitment. Rather than filling positions hastily, we work closely with our clients to understand their long-term goals, helping them build teams that can drive sustained success in the investment world.

Personalized Service: Our tailored recruitment strategies are designed to meet the unique needs and aspirations of each client and candidate. We provide personalized attention, guidance, and support throughout the entire recruitment process.

PAST PE FIRM AND CORPORATE SEARCHES

CEO

March 2023 for Luke’s Ice Cream/ College Circle Creamery

PE Client: College Hill Capital Partners, LLC

Director of Marketing

August 2022 for MCE Systems

Client: Corporation

CFO

November 2021 for Blue Chip Group in 57 days

PE Client: 3 Rivers Capital

CEO/President

November 2020 for Merrill Industries in 65 days

PE Client: Ironwood Capital

CEO

November 2019 for Pawz Inc.

PE Client: Circle Square Capital

ARE YOU INTERESTED IN OUR TALENT ACQUISITION SERVICES?

Q & A

Who are BlackmoreConnects Talent Acquisition (TA)?

BlackmoreConnects (TA) work with PE firms to scout out C -C-suite-level executives, who are Exceptional, Experienced, and Proven. BMC Executives are “hand-picked” and thoroughly screened and interviewed before they can continue down the BMC pipeline and over into the PE connection process.

What is BMC TA's targeted niche?

We offer buy-side and sell-side PE focused advisory for platform and add-on deal opportunities, consulting, and TA services.

What makes BMC TA standout?

We cover all aspects of due diligence to ensure we create an Executive funnel explicitly vetted to be of the highest caliber which Private Equity demands.

How does BMC TA tie into other BMC services?

Given BMC TA’s proven track record in TA. We have built a trusted pipeline and funnel between Executives and PE firms. BMC’s close relationship with Top notch Executives and successful PE firms make BMC your “All-in One” partner for Deals and CXO opportunitiesC

For PE partners:

PE|VC|Family owned companies: strongly positioned for portfolio companies who need Top notch Executives, Board members or CXO for a transition; including Industry Experts to examine deals with Due Diligence (DD).

Corporations: When you need a vetted funnel of BMC Executives who can jump in and take the rein of critical positions that cannot miss a beat.

Internal Support: BMC deals we are working on or which have been executed

Active Deals searching for operating partners with defensible Deal Thesis and later will provide Due Diligence consulting.

Support for our PE portfolio companies who need to complete the Executive teams and Board members post on M&A transactions.