Understanding Private Equity's Concerns: A Roadmap for Executives to Navigate the Current Market

Written By: Gerald O’Dwyer II

The PE Guru — BlackmoreConnects, Inc | October 14, 2024

I was reading Bloomberg, and I started thinking about how I advocate the importance of understanding what PE is concerned with in general. I have talked about how you cannot operate in a vacuum; you need to have context about your funders. Today, more than ever, executives running lower middle market (LMM) companies for private equity (PE) must be in tune with the challenges and concerns of their PE backers.

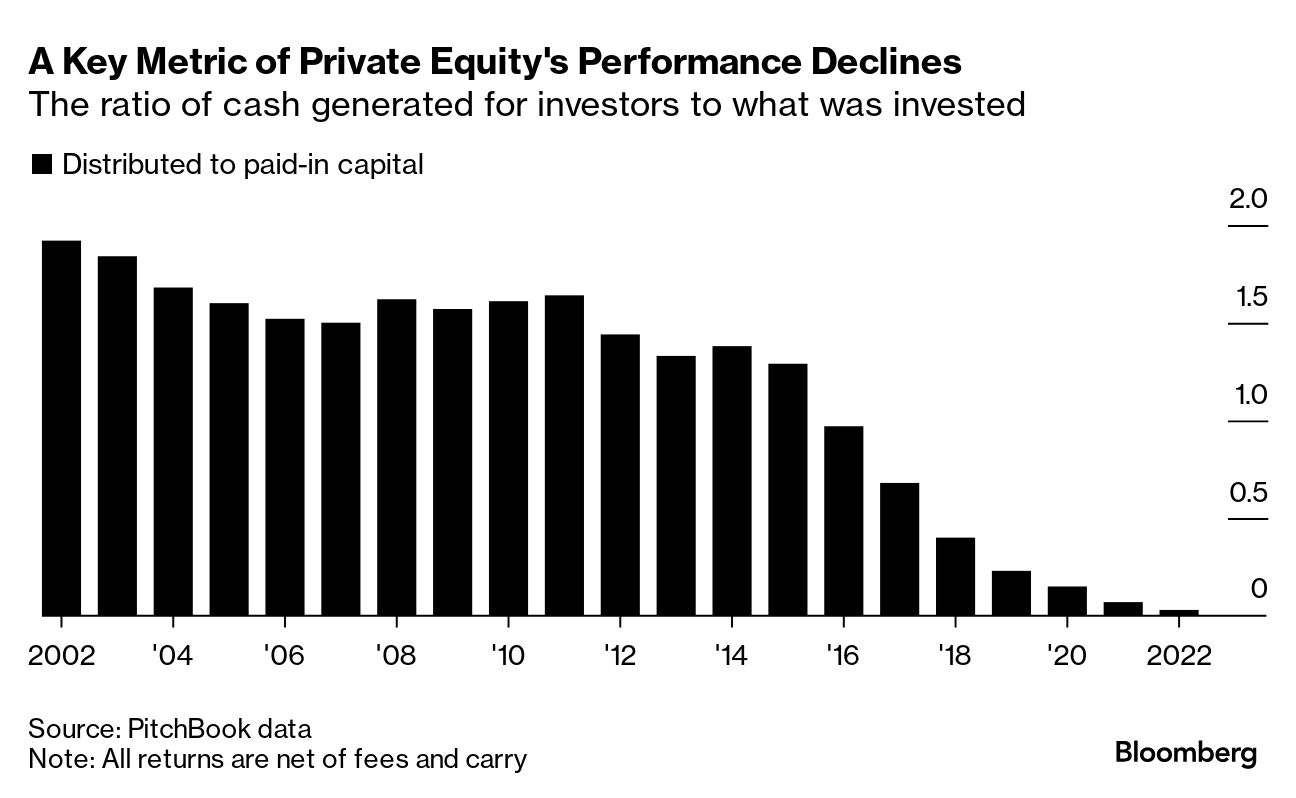

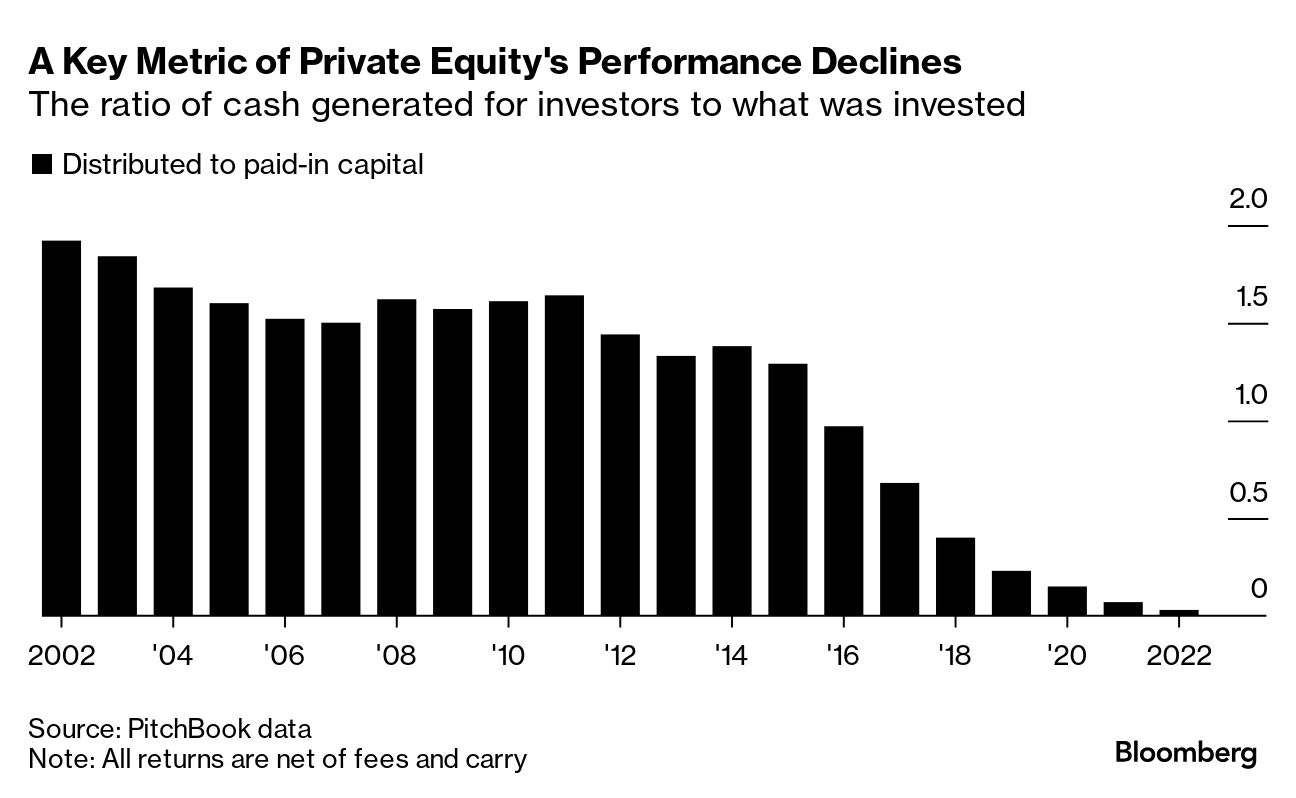

A recent chart on the declining performance of private equity highlighted one key metric: Distributed to Paid-In Capital (DPI), the ratio of cash returned to investors relative to what was initially invested. Here’s the version of the chart that sparked my thoughts:

A Key Metric of Private Equity’s Performance Declines

The ratio of cash generated for investors to what was invested (Distributed to Paid-In Capital)

This chart made me reflect on how crucial it is for executives to understand that private equity’s expectations are evolving. In the past, the DPI numbers were more robust, meaning higher cash returns for investors. Today, however, the game has changed. PE firms are more cautious, and executives running their portfolio companies must take specific actions to address the concerns raised by this declining metric.

1. Increased Scrutiny on Investment Returns

Private equity firms are seeing diminishing returns, and with the DPI ratio on a downward trend, their focus on operational performance is sharper than ever. As an executive, your performance is under the microscope. You need to demonstrate that you are capable of optimizing returns by driving real value in your company.

What You Must Do:

When discussing your leadership approach, emphasize a data-driven strategy focused on improving operational metrics. For example, point out how you increased EBITDA by 15% through cost reductions, operational efficiency, or entering high-margin markets. The key is to show that your leadership has a tangible impact on profitability.

2. Prioritizing Exit-Oriented Decision Making

Private equity is not about running companies forever; it’s about optimizing for an exit. The declining DPI underscores the need for a more calculated approach to preparing businesses for sale. PE firms are more likely to back executives who think strategically from the get-go and are actively positioning their portfolio companies for successful exits.

What You Must Do:

In your discussions with private equity partners, speak the language of exits. Share your plan for creating value and positioning the business to be attractive to strategic buyers or other financial investors. Provide examples of how you’ve prepared a company for sale in the past, focusing on value-building initiatives like diversifying the customer base or optimizing the cost structure.

3. Emphasizing Financial Stewardship and Capital Efficiency

PE firms are now more concerned with cash preservation and the efficient use of capital. In the lower middle market, this becomes even more important because smaller companies often have thinner margins for error.

What You Must Do:

Showcase how you’ve led companies through financial transformations. For instance, did you successfully reduce working capital needs by optimizing supply chain efficiencies? Talk about how you improved return on invested capital (ROIC) and reduced waste, ensuring that every dollar spent was directly tied to growth or efficiency.

4. Managing Inflation and Economic Headwinds

In this economic climate, inflation, interest rates, and supply chain disruptions are top concerns for PE firms. They want to know how the leaders of their portfolio companies are prepared to manage through tough times and still generate returns.

What You Must Do:

Talk about your ability to maintain profitability even during economic downturns. Discuss specific strategies you’ve used to navigate inflation, such as passing on increased costs to customers through price adjustments or securing long-term contracts with suppliers to hedge against volatility.

5. Agility in Market Shifts

As market conditions fluctuate, PE firms want leaders who can pivot quickly. The decline in DPI may indicate longer hold periods, meaning PE firms need executives who can steer companies through dynamic environments while maintaining a focus on growth and an eventual exit.

What You Must Do:

Provide examples of how you’ve led a company through significant market changes. Maybe you shifted a product strategy in response to new competition or rapidly expanded into new markets when opportunities presented themselves. Show how your agility protected value and positioned the company for long-term growth.

The Bottom Line: Addressing PE’s Concerns Proactively

In this environment, PE firms expect more from the executives they back. The declining DPI ratio is a reflection of the pressures that both the firms and their portfolio companies are facing. To be the right person to run an LMM company in today’s private equity world, you must demonstrate that you understand these challenges and can provide proactive solutions.

The most effective executives are those who come to the table with a clear strategy that addresses the operational, financial, and strategic concerns of their PE backers. It’s no longer enough to just keep the ship steady. Executives must drive growth, prepare for exit, manage capital efficiently, and navigate economic turbulence. Understanding the context of your funders and their expectations is what will set you apart and make you the right fit for leadership in today’s lower middle market.

If you’re aiming to take on one of these roles, remember that private equity is ultimately about results, and your ability to deliver on their investment thesis is paramount. Be prepared, be strategic, and show that you’re the leader they need in this challenging market.