Written by: Gerald O’Dwyer The PE Guru

Introduction

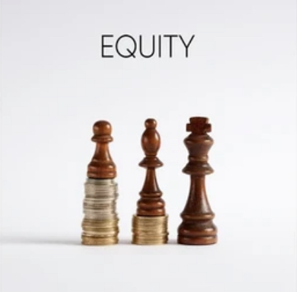

Equity ownership in a PE (Private Equity) -owned company is a powerful tool that allows executives to directly benefit from the company’s success. One strategic approach to significantly increase the executive’s equity value is by buying the company at a lower EBITDA multiple and then selling it at a higher exit multiple. This article will explore how this strategy can lead to substantial gains for the executive’s equity value, providing a compelling incentive to align their efforts with long-term growth and profitability.

The Power of EBITDA Multiples

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) multiple is a key valuation metric used in the PE industry to assess the attractiveness of an investment opportunity. It represents the company’s enterprise value divided by its EBITDA and serves as a proxy for the company’s potential return on investment.

Buying at a Lower EBITDA Multiple

When a PE-owned company is acquired at a lower EBITDA multiple, the purchase price is comparatively lower in relation to its earnings potential. This allows the executives, who are also equity stakeholders, to secure a larger ownership stake for the same investment amount. As the company performs and grows, the value of the executive’s equity ownership increases, providing a foundation for substantial returns.

Selling at a Higher Exit Multiple

The ultimate goal of any PE investment is to generate attractive returns upon exit. A higher exit multiple indicates a higher valuation at the time of sale. By nurturing the company’s growth and implementing strategic initiatives, the executives can position the company for a more profitable exit, thus unlocking significant gains for their equity value.

Illustration: Impact of EBITDA Multiples on Executive’s Equity Value

Let’s consider a hypothetical scenario to understand the impact of EBITDA multiples on the executive’s equity value.

Assumptions:

- Current EBITDA: $10,000,000

- Initial Equity Ownership: 5%

- Initial Company Valuation: $200,000,000 (EBITDA multiple of 20x)

Equity Value at Entry: Equity Value = 5% * $200,000,000 Equity Value = $10,000,000

Scenario 1: Selling at 7x EBITDA Exit Multiple

- Exit EBITDA: $10,000,000 * 7

- Exit Valuation = Exit EBITDA * Exit Multiple

- Exit Valuation = $70,000,000

Equity Value at Exit: Equity Value = 5% * $70,000,000 Equity Value = $3,500,000

Scenario 2: Selling at 9x EBITDA Exit Multiple

- Exit EBITDA: $10,000,000 * 9

- Exit Valuation = Exit EBITDA * Exit Multiple

- Exit Valuation = $90,000,000

Equity Value at Exit: Equity Value = 5% * $90,000,000 Equity Value = $4,500,000

Conclusion

The strategic approach of buying a PE-owned company at a lower EBITDA multiple and selling it at a higher exit multiple has a profound impact on the executive’s equity value. By acquiring the company at a lower valuation and diligently working towards increasing its value, executives can significantly enhance their equity ownership’s worth. This incentivizes executives to adopt a long-term perspective and make decisions that drive sustainable growth and profitability, ultimately benefiting both the company and its equity stakeholders. The potential for substantial returns through strategic EBITDA multiples underscores the attractiveness of equity ownership in PE-owned companies and highlights its potential as a powerful incentive for executives.