Case Study: Strategic Networking and Skill Development for Executives in Private Equity in the face a major economic headwinds and mass layoffs.

Written By: Gerald O’Dwyer III

The PE Guru — BlackmoreConnects, Inc | June 22, 2024

In the current economic landscape, executives seeking to transition into or advance within private equity (PE) must be strategic and proactive. This case study focuses on two types of executives: one looking for PE firms that need their specific skill set and sector expertise, and another developing a deal thesis and building a funnel of potential targets. Both executives recognize the importance of attending industry conferences to enhance their knowledge, network, and opportunities for success.

The Current Economic Landscape

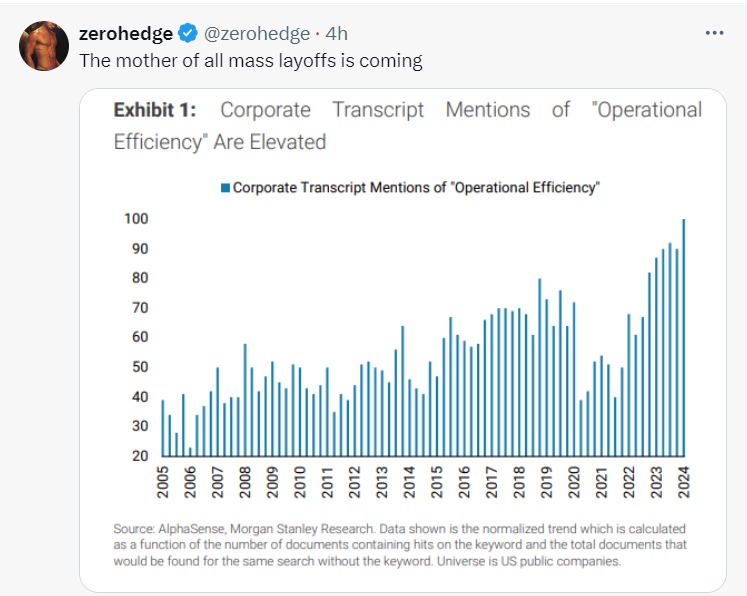

The economic downturn, reminiscent of the 2008-09 financial crisis, has led to a surge in corporate mentions of “operational efficiency,” signaling heightened concerns about cost management and layoffs.

Typical Mental Errors in Private Equity Decision-Making to spend or not spend on PE conferences.

- Confirmation Bias

- Description: The tendency to search for, interpret, and remember information in a way that confirms one’s preconceptions.

- Example: An executive might focus on data that supports their initial investment thesis while ignoring evidence that contradicts it.

- Overconfidence Bias

- Description: The tendency to overestimate one’s own abilities, knowledge, or the accuracy of one’s predictions.

- Example: An executive might overestimate their ability to turn around a struggling company, leading to overvaluation and poor investment decisions.

- Anchoring

- Description: Relying too heavily on the first piece of information encountered (the “anchor”) when making decisions.

- Example: An executive might base their valuation of a company on an initial asking price rather than on thorough due diligence.

- Recency Effect

- Description: Giving undue weight to recent information over historical data.

- Example: An executive might make decisions based on the latest quarter’s performance, overlooking long-term trends.

- Herding

- Description: The tendency to follow and imitate the actions of a larger group.

- Example: An executive might invest in a particular sector because it is currently popular, rather than based on independent analysis.

- Loss Aversion

- Description: The tendency to prefer avoiding losses over acquiring equivalent gains.

- Example: An executive might hold onto a failing investment longer than rational analysis would suggest, to avoid realizing a loss.

- Availability Heuristic

- Description: Estimating the likelihood of events based on their availability in memory; if something can be recalled easily, it must be important.

- Example: An executive might overestimate the potential of a high-profile industry due to its recent media coverage.

- Sunk Cost Fallacy

- Description: Continuing an endeavor once an investment in money, effort, or time has been made, even if it’s no longer the best option.

- Example: An executive might continue funding a project because significant resources have already been invested, rather than cutting losses and reallocating resources.

- Status Quo Bias

- Description: Preferring for things to remain the same rather than change.

- Example: An executive might resist restructuring a company because of a preference for maintaining the current state of affairs.

- Endowment Effect

- Description: Valuing something more highly simply because they own it.

- Example: An executive might overvalue a portfolio company they acquired and are managing, hindering objective assessment and decision-making.

Strategies to Mitigate These Errors

- Diverse Perspectives: Encourage input from a variety of team members and external advisors to challenge assumptions. Attend the “PE Mastermind” groups at BlackmoreConnects. By attending full conferences, you can meet 8-10 PE firms that will give you coaching.

- Data-Driven Decision Making: Rely on comprehensive data analysis rather than intuition or anecdotal evidence.

- Regular Training: Provide training on cognitive biases and decision-making frameworks. Attend the “PE Mastermind” groups at BlackmoreConnects. By attending full conferences, you can meet 8-10 PE firms that will give you coaching.

- Checklists: Use decision-making checklists to ensure all relevant factors are considered.

- Devil’s Advocate: Assign someone to argue against the proposed decision to uncover potential flaws. Attend the “PE Mastermind” groups at BlackmoreConnects. By attending full conferences, you can meet 8-10 PE firms that will give you coaching.

- Scenario Planning: Evaluate multiple scenarios and their potential impacts to broaden perspective. Attend the “PE Mastermind” groups at BlackmoreConnects. By attending full conferences, you can meet 8-10 PE firms that will give you coaching.

- Post-Mortem Analysis: Conduct reviews of past decisions to learn from mistakes and successes. Attend the “PE Mastermind” groups at BlackmoreConnects. By attending full conferences, you can meet 8-10 PE firms that will give you coaching.

The Case for Attending BlackmoreConnects and ACG Conferences

Overview

Attending industry-specific conferences, such as BlackmoreConnects virtual conferences and ACG’s Capital Connection conferences, can significantly enhance an executive’s ability to navigate the complexities of the PE landscape. These conferences provide invaluable opportunities for networking, learning, and strategic development.

Key Benefits

- Knowledge Expansion

- Gain insights into the latest trends, best practices, and emerging opportunities in PE.

- Learn from experienced professionals and industry leaders about successful investment strategies and common pitfalls.

- Skill Development

- Improve decision-making skills by understanding cognitive biases and learning techniques to mitigate them.

- Develop a robust framework for evaluating investment opportunities and managing portfolio companies.

- Networking Opportunities

- Build relationships with over 200 PE firms, industry experts, and potential partners.

- Create a network of trusted advisors and mentors who can provide guidance and support.

- Resource Access

- Utilize resources like www.pitchbook.com, www.cyndx.com, and D&B databases to conduct thorough market research and due diligence.

- Gain access to proprietary data and insights that can inform investment decisions.

- Strategic Insights

- Understand the importance of management’s equity ownership, the correlation of efforts to rewards, and the risk side of the equation in PE roles.

- Learn how to structure deals to maximize value creation and achieve successful exits.

Recommended Conferences

- BlackmoreConnects Virtual Conferences (6 per year)

- Focus on networking with PE firms and executives.

- Emphasis on practical strategies for value creation and deal structuring.

- Interactive sessions and workshops designed to enhance skills and knowledge.

- ACG Capital Connection Conferences (2 per year)

- Major networking events attracting a broad range of industry professionals.

- Sessions on market trends, investment opportunities, and economic forecasts.

- Opportunities to connect with potential investors, partners, and acquisition targets.

Investment Rationale

- Building a Strong Network

- Attending these conferences will help executives build a strong network of industry contacts, which is crucial for sourcing deals, securing financing, and achieving successful exits.

- Continuous Learning and Improvement

- Regular participation in these events ensures that executives stay up-to-date with industry developments and continuously improve their skills and knowledge.

- Access to Exclusive Opportunities

- Conferences provide access to exclusive investment opportunities and insights that are not readily available through other channels.

- Enhanced Decision-Making

- Exposure to diverse perspectives and expert insights will help executives make more informed and objective investment decisions, reducing the risk of cognitive biases.

- Strategic Growth and Value Creation

- The knowledge and connections gained from these conferences will enable executives to implement effective strategies for growth and value creation, ultimately leading to more successful exits.

Financial Example: Comparing Two Executives

Scenario:

- Executive A: Does not attend conferences, relies on existing knowledge and network.

- Executive B: Regularly attends BlackmoreConnects and ACG conferences, leverages new knowledge and networks.

Outcomes:

- Deal Sourcing:

- Executive A: Sources 2 deals per year with a 10% success rate.

- Executive B: Sources 6 deals per year with a 20% success rate due to enhanced networking and insights.

- Investment Returns:

- Executive A: Achieves 10% average annual returns.

- Executive B: Achieves 15% average annual returns due to better-informed decision-making and strategic insights.

- Exit Value:

- Executive A: Average exit value of $50 million.

- Executive B: Average exit value of $75 million due to improved value creation strategies.

Conclusion

Understanding and mitigating cognitive biases are critical for executives entering the PE arena. By leveraging the networking, learning, and resource opportunities provided by BlackmoreConnects and ACG conferences, executives can enhance their decision-making capabilities, build valuable industry connections, and achieve successful exits. The investment in attending these conferences is a strategic move that offers significant long-term benefits in knowledge expansion, skill development, and resource access, making it an essential component of any executive’s professional development plan in the PE sector.

Strategic Action Plan

- Enroll in Six BlackmoreConnects Virtual Conferences Annually

- Focus: Networking with PE firms, practical strategies for deal structuring, interactive workshops.

- Attend Two ACG Capital Connection Conferences Annually

- Focus: Market trends, investment opportunities, economic forecasts, connecting with potential investors and partners.

- Utilize Online Resources

- Tools: www.pitchbook.com, www.cyndx.com, and D&B databases for market research and due diligence.

- Implement a Bias for Action

- Strategy: Regularly update deal thesis, engage in continuous learning, and proactively seek new opportunities.

By adopting this action plan, executives can position themselves effectively within the PE landscape, ensuring they are well-equipped to navigate economic downturns, leverage opportunities, and achieve successful exits.